I have always being the kind of person that I can’t trust what the media says out-of-the-box. Why? Well, because many times I have seen that they are not always telling the truth. More importantly, they don’t call it lying, they just tell you a modified version of the truth. They are extremely good in the use of words and creating news instead of reporting what they really see.

One thing that I have been following lately is the “recovery” of the US economy. If you take a look at the last 9 months of the DOW JONES an index that for the most part represents the US (stock market), you would see that it has been going up and and up and up.

Now, the weird thing about this is not that it has been going up. The question is not why. It is obvious that the stocks are getting more expensive and that companies have investment money. The problem with this is that consumer expending is not there. In other words, investors (some important ones) have decided to put their money into the market buying companies that have no sales, but that they know that are not going to fail. For example, the government said that AIG was too big to fail, so it decided to give bailout money to the company to prevent it from crashing. The unfortunate thing that they did at the same time is that they created a bubble.

An Analogy

If you had money and you went to a casino, and in that casino was a game that has the following rules:

1. You are allowed to bet any number from 1 to 36.

2. Number 23 pays 35 to 1. And if you lose your money with this number, the dealer is going to bail you out giving you back your money so you don’t lose.

What would happen is that you would bet on that number over and over again until pretty soon everybody would notice and they would start betting that number too. Then, the casino would notice that this can’t continue and has to do something about it.

Well, the stock market is going up because the banks can’t fail. The government decided that some banks are just too big to fail, in other words, all the people that had their money invested in those banks didn’t lose a cent. Those big banks did everything they could wrong. They made every single bad decision. They not only gave credit to people that couldn’t pay back, they also took those loans (that are worth zero) and packaged them and sold them in the stock market. By packaging something that is worth nothing you buy yourself some time. Imagine somebody giving you a gift for Christmas in November. The gift is really a piece of dog crap, however since it is wrapped you don’t see it. You know it smells bad, but you don’t open it until is the right time. That is exactly what they did with these bad loans. They packaged them so that they would hide their real value for a while.

Google Trends for Shopping

The government had to rescue them: can you believe that? Why? Well, according to the people at the top, if they let them fail the economy would suffer so much that we would never have the same quality of life.

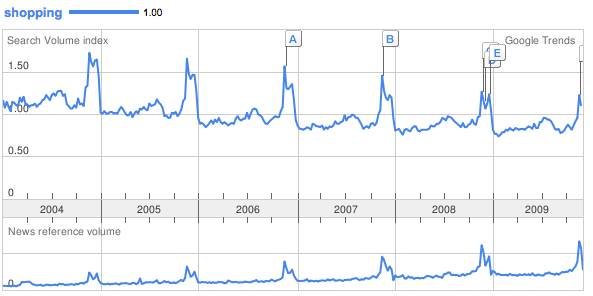

Now, that is not the part that concerns me. Let’s take a look at Google trends for shopping in the US:

As you can see in the graph the news reference volume has increased but the search volume keeps decreasing. You would expect that the 2009 part of the graph would look the same as the previous graph for the Dow Jones Index, but it doesn’t. You know what this means? That consumers are not in the same note as investors.

No money and no credit.

Now, there may be many explanations for this. The most likely explanation for me is that the average American has neither money nor credit. They have no money because at least 20% of the population is unemployed. They have no credit because they have maxed out their multiple credit cards and have defaulted in their minimum payments; this payments for credit that they shouldn’t have used for financing consumer goods in the first place. In business school you learn that you want to use long term debt to finance fixed assets and short term debt to finance variable assets: NO DEBT for NO ASSETS. Consumer goods are not assets:period.

When you buy a new LCD tv on credit card while using it to finance it you are walking into dangerous waters. But when most average Americans do the same it is not just dangerous waters, it is tsunami waters.

If you use credit cards to finance your purchases is because you don’t have the money to buy them in the first place. Conventional wisdom would also tell you that if you don’t have the money to buy them right now, you won’t have it later. However, people enjoy buying stuff. I do too. Isn’t it cool to go to Walmart and walk out with a huge TV? Isn’t it cool to go to the mall and buy three pairs of shoes in three different colors?

Well, if you don’t have the money for it then is not so much fun, because you will at some point have to stop those desires: and people can’t. Banks know that. If they train you into getting pleasure from buying stuff, all they have to do is sit down and wait. As a society we keep buying consumer goods (things that don’t produce value). We keep buying because it gives us pleasure. Then we feel bad because our credit cards have big balances. We try to reduce those balances by working harder and we get tired and stressed. We keep making minimum payments and we continue to feel bad. Obviously you can’t feel bad forever, so you give yourself some pleasure to escape the pain: you go buy stuff.

One Day is just too much to handle

One day is just too much. You can’t do it anymore. You can’t keep running in this treadmill that is getting faster and faster. So you basically say “I can’t pay it”. You find a lawyer and you declare yourself “bankrupt”. What happens with your creditors? You would think that they suffer because they have no money. Not really. All this time they have been collecting from you. You created an asset for them. They gave you a super short term loan at a high interest rate. They have plenty of money. In fact they have so much money that they don’t know what to do with it. This banks have so much money that they build buildings with big offices that they don’t even need. They give bonuses to their executives. Those bonuses are ridiculous, they are so big that they can’t believe they make so much money. In fact, they have so much money that they make the rules of the game. They don’t really like when you don’t pay. They actually give you a bad credit score if you default on your loans, but also they give you a bad credit score if you don’t have loans at all.

The real problem is that these banks and their investors get so big and with so much power that they control everything. Including the stock market. In other words, if they take the money away from the market, the market crashes. And that is exactly what happened. They gave the present with crap inside to make even more money. Once they knew that the gift was to be open, they sell their positions so that they are not losers in the game. Is like the dancing chairs game. People dance until the music stops, then somebody ends without a chair. Well, the banks are playing the game, but they are the ones that stop the music.

The real problem now is that perhaps regular people like you and me can’t play the game anymore. Americans are suffering today. A large number of the population has no job, the government says 10% to make sure people don’t panic. 10% is nothing, why is it such a big deal if it is only 10%? That would mean that 9 out of 10 people have a job and are making good money. Do you really believe that?

We have nothing, the banks have it all

People have no more money, is now all in the hands of the banks: they took it with the credit card deals. People have no houses, they were foreclosed, now are in the hands of the banks. They have now a deal were they rent it to the people that used to own them. In other words, if they still have money they give it to the bank now but the house will never be theirs.

People have no cars. The banks own the cars. The cars people owned have been destroyed by programs like Cash-for-clunkers, they changed them in exchange for cars that have a payment attached to them. They are going to lose those cars because they can’t really pay for them… it is too much. The car they used to own has been destroyed and can’t be used anymore.

People have no credit. The banks decided not to lend the money to the people, because they want to keep it for themselves. They know people can’t pay it back, so why give it to them in the first place?

People have no jobs. The banks own the jobs. They could lend money to businesses with good ideas in order to create jobs, but they don’t. They don’t want to take any risk. They want to hold all the cards.

People have nothing. They are distracted by TV shows at night and they do anything to fight for a job. They are willing to over-work: this makes them even poorer.

Do you know why the stock market is up? Simple, because the big guys have their money invested in the market. They bought stocks when they were at their lowest. They bought the stocks of companies that are worth way less. Why? Because without sales businesses are worth very little. Once they make some more money and they have repaid the government for all the bailout money… then they will take their earnings and protect them again. Leaving the market empty.

Japan

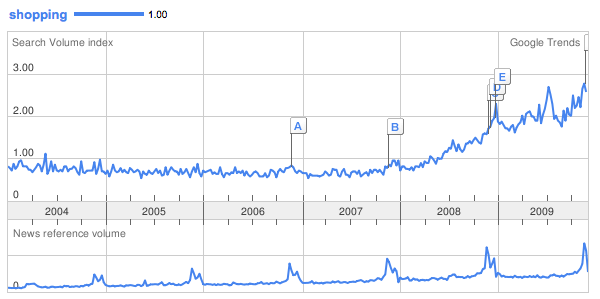

You know where they put the money that they extract from this economy? Japan and other places that have growing consumer power. Let me show you how Google Trends shows the trend for shopping in Japan:

The Big Mac Index shows that the wages in Tokyo are the highest among principal cities in the world according to Wikipedia. In other words, their buying power is huge. And banks love to hear that.

Final Remarks

There is a big structural problem in the US. There are plenty of people deceived into believing that they don’t have to work hard to make money. The entertainment industry is so big and powerful that its marketing convinces people to change work for production. A large number of us wants to work in an office and providing services not goods.

The governments bailout is going to work in the short term there is no question about it. The government is injecting direct cash into businesses all over the country. Those businesses will pay their employees which in turn will be able to pay their credit cards and continue to buy stuff.

However, I don’t really see how the government can bailout everybody everywhere. It is just not possible. The average wages in the US will go down as more and more people compete for the available jobs. With less money in their hands, less businesses will be able to survive. With more businesses failing more people will lose their jobs.

An impossible solution

When can companies start hiring again? When consumers are requesting their products and services. When will customers start buying again and using their consuming power. When they have money. When will they have money? When they can work. They will work when companies start hiring again.

Somebody has to have faith and desire. The only ones that have that power are the banks. They are the only ones that have everything. The banks have to give money to businesses that they believe won’t be able to pay back. WHAT? Are you serious? Yeah. They have to give money to people that can’t pay back.

In my opinion is time for this country to turn to God and revive the christian belief that made this country great. At the foundation the forefathers lived by christian belief. They were Christians and they behaved like such.

Matthew 5:42 of the Bible says the following:

42Give to the one who asks you, and do not turn away from the one who wants to borrow from you.

I personally think that is the solution. Once small businesses have money, they will use that money to pay more people to make good products and services and to grow. But that will only happen if the banks give money to people that can’t pay back.